August 1, 2025 Nick Proctor

10 Years of strategic leadership: Amber’s Protect100 energy fund delivers outstanding results

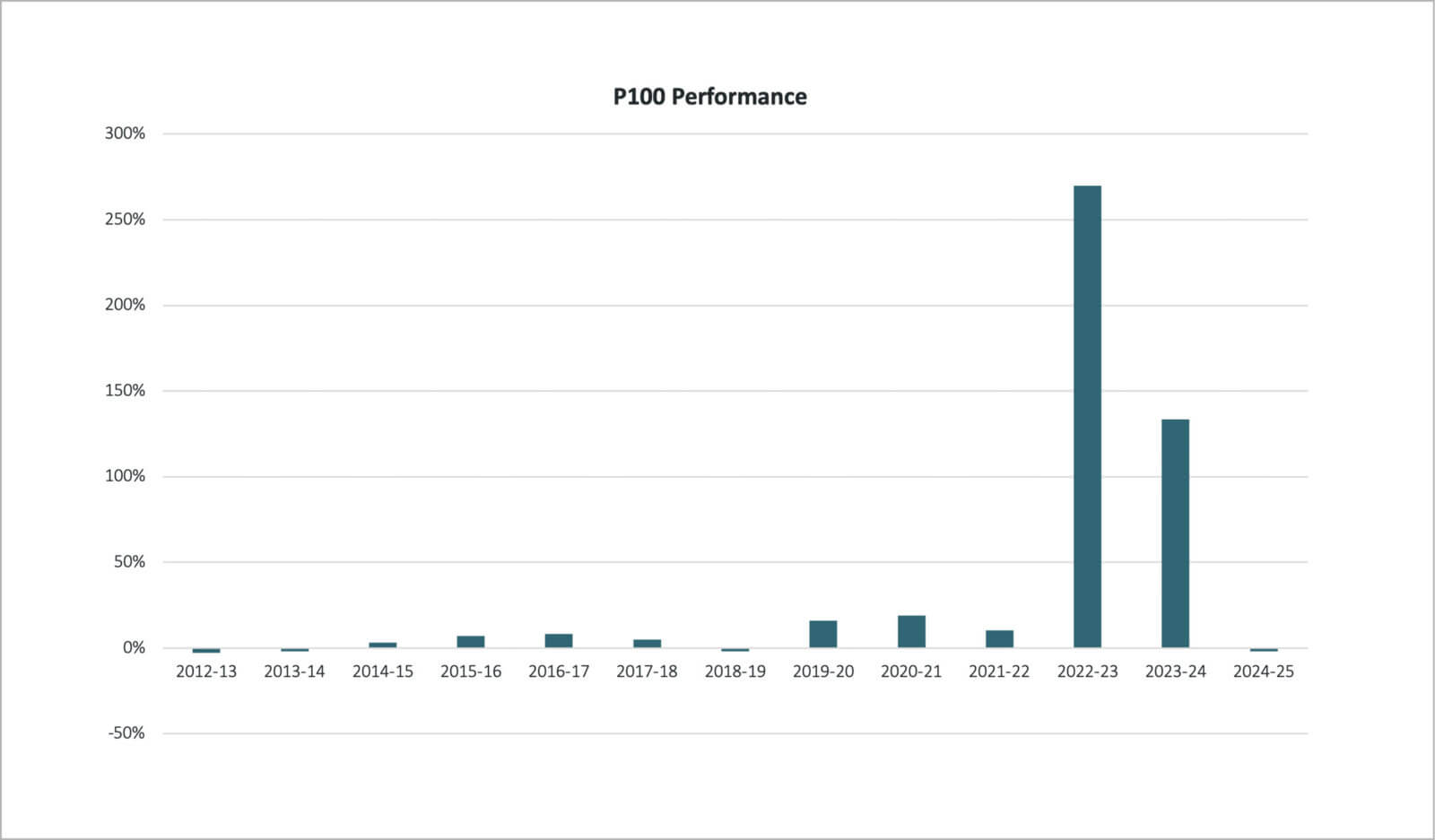

In the fast-moving and often unpredictable world of energy trading and risk management, consistency and foresight are essential. We are therefore delighted to reveal that the Amber Protect100 Energy Fund has just completed a remarkable 10-year performance run, delivering an impressive 46.4% outperformance against the market average. This milestone reflects the fund’s deep-rooted strategic vision, disciplined execution, and unwavering commitment to protecting clients from volatility.

A decade of purpose and protection

Established with a clear mission to shield medium to large UK energy users from volatile pricing, the Protect100 Fund has delivered on its promise through a sophisticated blend of progressive hedging techniques and robust risk management.

The result? Budget certainty, measurable cost savings, and confidence for businesses navigating one of the most dynamic commodity markets.

Under the leadership of Josh Tomlinson, Procurement, Trading & Risk Director, and Mark Dimelow, Head of Trading & Risk Management, the fund has adhered to a risk-averse philosophy, prioritising protection over speculation. With tools like dynamic price triggers and fully fixed rates for each annual delivery period, the fund has provided a stable, reliable strategy for securing both electricity and gas positions year after year.

Year-by-year highlights

Over the past decade, the fund’s performance has reflected both tactical discipline and the ability to adapt in real time:

- 2015-2017: Consistent gains of +7% and +8% during stable market conditions, as traders seized favourable pricing windows.

- 2019-2021: A bold and timely response to the COVID-19 downturn led to a cumulative +35% return, taking advantage of reduced energy demand.

- 2022-2023: At the height of the global energy crisis following Russia’s invasion of Ukraine, Amber delivered extraordinary returns (+270%, followed by +133%) by locking in positions early and decisively.

- 2024–2025: Despite a challenging post-crisis environment, the fund achieved a result in line with market averages (-2%), underscoring its resilience and stability.

Responding to global turmoil

From the pandemic-driven demand collapse in 2020, to the 2022 energy shock, and more recently the 2024 Middle East instability, the fund has remained agile and responsive.

In 2025, while others scrambled to respond to a cold winter and renewed geopolitical tension, our fund had already secured key positions, shielding clients from price spikes.

Looking ahead to 2026–27, the fund continues to monitor the dual forces of expanding LNG supply and the potential for another cold winter, preparing once again to protect client interests through smart, early hedging.

Looking ahead

As global energy markets evolve, the Protect100 stays focused on its core mission: providing clarity, stability, and confidence in uncertain times.

Rather than reacting to every market tremor, the fund takes a proactive, data-driven approach, identifying opportunities to hedge strategically ahead of key seasonal and geopolitical events. This forward-thinking method reduces exposure to volatility and helps clients manage costs with precision.

What sets Amber apart is our commitment to disciplined, non-speculative trading. By prioritising protection and predictability, the fund empowers our clients to plan confidently, even when market conditions are anything but predictable.

In a market where others chase short-term gains and often falter, Amber Protect100 has delivered long-term value, resilience, and trust. With 46.4% outperformance over the market average and a philosophy grounded in integrity, it stands as a benchmark for how energy funds should operate – strategically, responsibly, and always with the client in mind.